TRIAL HOLDINGS showed its strategy after the acquisition of SEIYU at a media conference held in Tokyo on August 13. The company acquired all shares of SEIYU on July 1 and completed its wholly-owned subsidiary acquisition. In addition to rebuilding the operation of SEIYU stores, the company will pursue group synergies through the expansion of store openings, product development strategies such as PB, as well as utilization of IT data. Accelerating discussions on specific measures between the two companies, the Group’s medium-term management plan will be formulated as early as in February 2026.

The media conference held for the first time after the acquisition of SEIYU was attended by Kazuhisa Kirishima, Senior Executive Officer, Head of Group Corporate Finance, and Daisuke Noda, Executive Officer, Head of Public Relations.

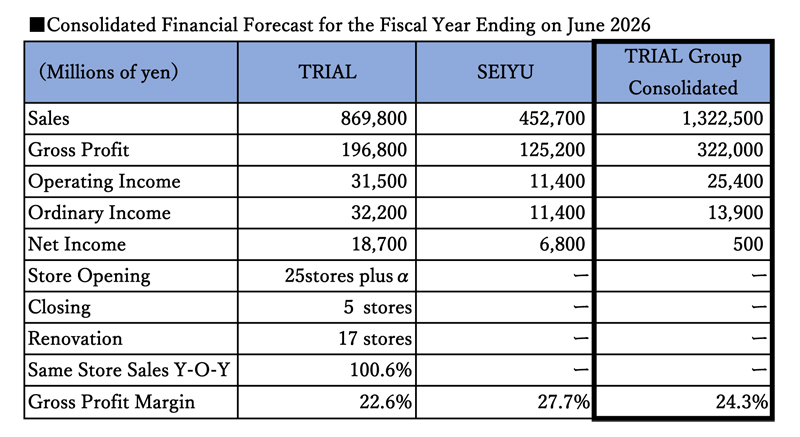

The earnings forecast for this fiscal year (fiscal year ending on June 2026) is that sales will be 1,322.5 billion yen due to subsidiarization of SEIYU, rising to 6th place in the retail industry. In addition to the benefits of SEIYU integration, the results of the gross profit growth strategy in TRIAL are expected to result in gross profit of 322 billion yen and a gross profit margin of 24.3%. Operating income increased by 1.9% year-on-year to 25.4 billion yen due to heavy SEIYU ‘s integration costs such as goodwill amortization.

The new store openings are planned to be 25 stores plus α (mega center: 1, super center: 22, smart: 2, small store: plus α). “We are preparing to open TRIAL GO store in Tokyo this fall to strengthen the Tokyo metropolitan area, and we plan to open as satellite around large SEIYU stores,” said Kirishima, senior executive officer. Like the “TRIAL GO” currently operating in Fukuoka City, the company plans to introduce self-payment and 24-hour service.

The year-on-year increase in same-store sales for this fiscal year was assumed to be 100.6%. The plan is to strengthen existing stores by strengthening “food” and continuing store renovations. “SEIYU’s same-store sales are on a downward trend. We will strengthen renovations and advertising to improve customer support. We will mutually utilize the PB and prepared foods of both companies to improve the attractiveness of stores throughout the Group.”

Quantitative integration synergies will be finalized going forward. In addition to improving purchasing terms (gross profit margin) through the integration of accounts in product procurement, the company will improve profitability by optimizing manufactured products, operation rates, and supply destination stores across the process centers (10 facilities), central kitchens (11 facilities), and distribution centers (50 facilities) of both companies.

In addition, the two companies will discuss specific measures pursuing expected synergies such as joint development of new formats, linkage of payment and membership measures, and sharing and mutual utilization of customer information, and will be announced in the second quarter financial results scheduled to be held in mid-February 2026.